How Payments work: Authorization

What is actually happening when a swipe occurs? How is money taken out of your account and into the hands of the merchant?

In the previous blog post, we were introduced to and learned a bit about the protagonists involved in every transaction.

In this post, we will focus on the first part: the Authorization phase.

Every day, numerous transactions occur in which products or services are purchased using a card. Before diving deep, let’s make it clear the nomenclature of different types of paying with a card:

• Swiping it: the card’s magnetic stripe is slid across the card reader.

• Dipping it: the card’s chip is inserted into the card reader.

• Tapping it: the card, mobile phone, or smartwatch is tapped on a contactless terminal.

•Entering it: typing it into a web browser to buy something online.

But what is actually happening when this swipe, dip, or tap occurs? How is money taken out of your account and into the hands of the merchant?

Authorization comes to the rescue!

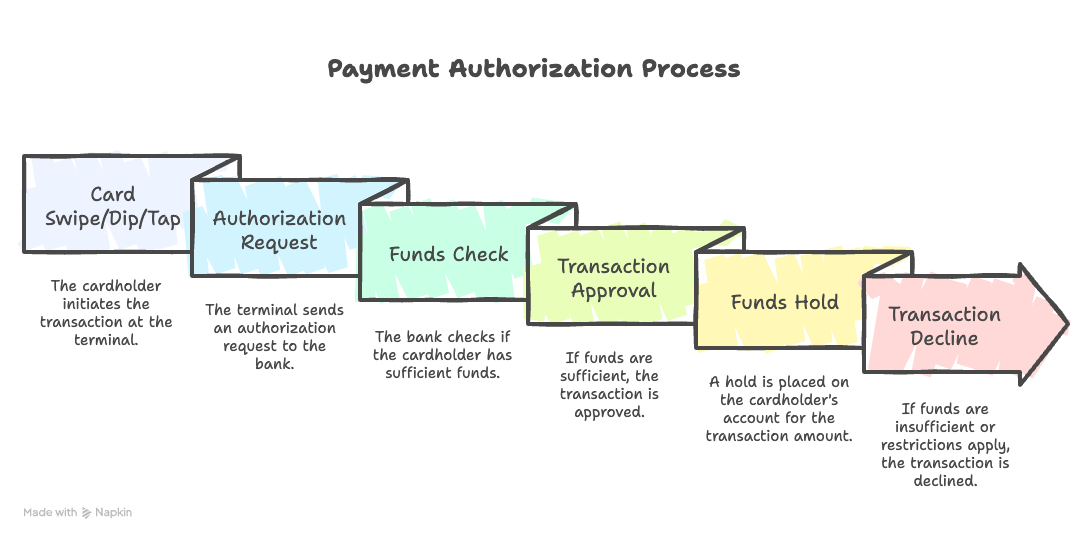

Authorization happens at the moment of the swipe, dip, or tap at the payment terminal. This action typically places a hold of funds on the cardholder’s account if the cardholder has enough money in their account, or it may decline the transaction if the cardholder doesn’t have enough money in their account or if other restrictions are on this type of spend, as we saw in the previous post.

It could seem simple, but in these three seconds (the amount of time that usually requires), a lot of things were going on. You, the person who is buying a new amazing course online, are involved in a Dual-Message Signature transaction with your debit card. Typically, an Authorization (message One) happens at the time of swipe, which was the process discussed above. This is then followed up with a Clearing phase (message Two) that happens in bulk at the end of the night, which will be discussed in the following blog post. In some cases, the Authorization message (message one) can be different from the Clearing (message two) if a tip is included (maybe if you pay a lunch in a restaurant) or some adjustment is made.

As you can see, a lot goes on within a very short period of time at the time of Authorization. The process is very quick because the networks are standardized on the ISO 8583 message. The ISO 8583 message is very compact and can travel quickly among the Payment Terminal, Acquirer Processor, Network, and the Issuer Processor.

The Authorization process places a hold on funds, but doesn’t actually move money at that very moment. The money gets withdrawn in the clearing process, which is what we will look at in our next post.

---

Want to learn more?

This post is part of my upcoming course, where you’ll learn the payment process flow and learn how to integrate payment systems such as Stripe and Paddle. If you are interested, join the waitlist.